|

|

| |

|

|

| |

House financing-i is a Shariah-based financing facility to finance the purchase of all types of residential properties including houses, flats, apartments or condominiums. |

|

|

|

|

|

|

| |

This financing facility can also be used to refinance existing housing loans, taken either from conventional housing loans or other house financing-i schemes.

The amount of financing provided by the Islamic banking institution depends on the market value (for completed properties only) or the price of the property. The margin of financing could be up to 95% of the property value, depending on the policy of the Islamic banking institution. The period of financing can be as long as 30 years or until the purchaser reaches age 65.

To find a house financing-i scheme that fits your financial needs, you should first shop around and compare the features of the similar products in the market. You should also pay extra-attention to the fees and charges imposed on these loans before making your final decision. |

|

|

| Things I Should Know |

|

|

| |

| What Else Can I Do? |

|

|

|

|

| |

|

|

|

| |

|

Term Financing |

-

-

|

|

| |

|

|

A facility with regular monthly instalments for a fixed period of time. |

|

Instalment payments consist of the Islamic banking institution’s purchase price (financing amount) plus its profits |

|

|

|

|

|

|

|

|

|

|

|

Cash Line (Overdraft) Facility |

-

-

|

|

| |

|

|

Cash line is granted to you based on a predetermined limit. |

|

No fixed monthly instalments as the profit is calculated based on daily outstanding balance or amount of

cash line utilised. |

|

The cash line is revolving in nature and the utilised amount that has been paid can be re-used. |

|

Principal is only due at the end of the financing tenure. This can be renewed upon request. |

|

The profit rate is generally higher than the profit rate for term financing. |

|

|

|

|

|

|

|

|

|

|

|

Term Financing and Cash Line Facility Combined |

-

-

|

|

| |

|

|

A combination of term financing and cash line facility. For example, 70% as term financing and 30% as

cash line. |

|

Regular financing instalments on the term financing portion is required. |

|

Flexibility on the payment of the cash line portion. |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

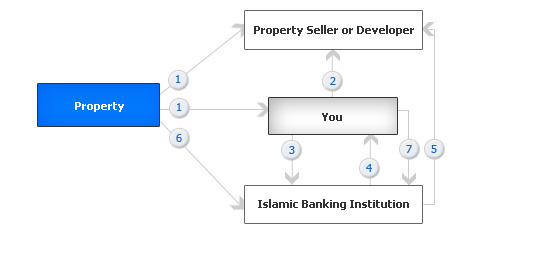

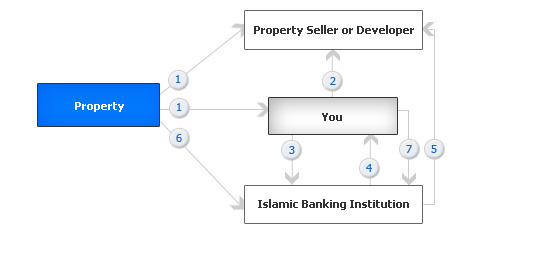

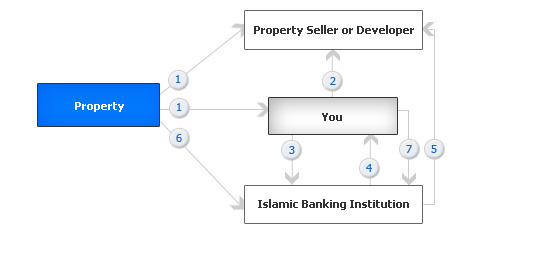

Identify the house you want to buy. |

|

|

|

Sign the Sale and Purchase Agreement (S&P) and pay the downpayment required. |

|

|

|

The Islamic banking institution will assess your application i.e. eligibility, tenure of financing and payment capability |

|

|

|

The Islamic banking institution will purchase the property from you through the Property Purchase Agreement. |

|

|

|

The Islamic banking institution will pay the developer or seller the purchase price (financing amount). |

|

|

|

The Islamic banking institution will sell the house to you at an agreed selling price (purchase price plus profit margin) through the Property Sale Agreement. |

|

|

|

You are required to pay the monthly instalments to the Islamic banking institution. |

|

| |

|

| |

|

| |

|

| |

| |

| |